Wake County Property Tax Rate 2024 Calculator Download

Wake County Property Tax Rate 2024 Calculator Download – Homeowners in multiple towns across Wake County could see their property rate for the 2024-25 fiscal budget until this summer when the budget process is complete. Based on a revenue-neutral . While it’s very likely Wake County with a $1,176 property tax In 2024, it would be worth $300,000 with a $1,393 property tax In the same time, because of the lowering tax rate, tax bills .

Wake County Property Tax Rate 2024 Calculator Download

Source : www.wake.gov

How To Charge Sales Tax in the US (2024) Shopify USA

Source : www.shopify.com

New, higher Wake County property values are out this week. What

Source : www.yahoo.com

How To Charge Sales Tax in the US (2024) Shopify New Zealand

Source : www.shopify.com

TOWF App | Town of Wake Forest, NC

Source : www.wakeforestnc.gov

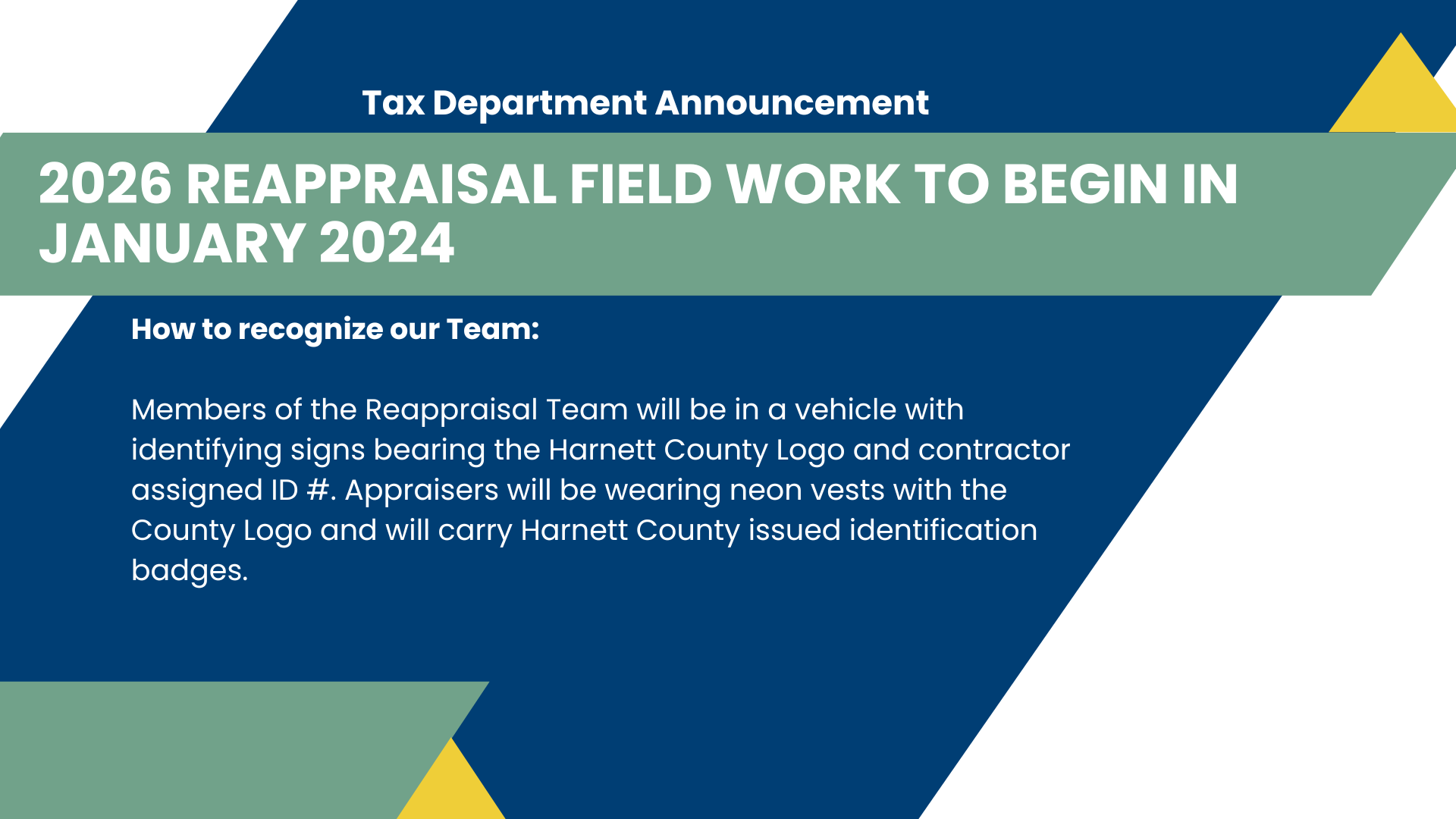

Tax Department: Welcome

Source : www.harnett.org

Hearing complaints over property taxes, some Georgia lawmakers

Source : news.yahoo.com

Tax Department: Welcome

Source : www.harnett.org

The Finch Blog Finch Unified Employment API

Source : www.tryfinch.com

Understanding the Management’s Discussion and Analysis (MD&A

Source : cricpa.com

Wake County Property Tax Rate 2024 Calculator Download Schedule of Values | Wake County Government: If the proposed revenue-neutral tax rate to county documentation. Wake County is estimating it will raise $1.4 billion in property taxes in fiscal year 2025, which runs from July 1, 2024 . RALEIGH, N.C. (WTVD) — Homeowners in Wake County may soon have to pay more in property taxes. County commissioners said they expect property values to increase when 2024 revaluations are sent out. .